Before you start investing

in the share market or share

trading, it is wise to adequately prepare. Before you start investing

in the share market or share

trading, it is wise to adequately prepare.

It is very useful to know "enough" about the markets - but how

much is

"enough"?

And what is really involved? Perhaps you have started

investing/trading

but without success?

Here is Robert's checklist to help you determine your level of

readiness.

It might look like a long list; but if you

can tick off every item, it will help you to be prepared.

Which financial instrument to trade or invest?

The discussion and information on this page is focused on share

market

trading and investing.

For simplicity, there are other financial instruments which are

not

mentioned here.

See

more information about alternative instruments (eg. bonds,

hybrids, forex, options, etc.)

Print this web page, and use it as a checklist - tick

the completed items, and circle the outstanding ones.

(Print it using the print option "shrink to fit".)

WARNING:

Investing in the share

market does

expose you to the risk of financial ruin.

If you proceed, please do so carefully.

This is not

advice of any sort. Always seek

professional guidance before taking action. |

|

Investing

or

trading in

the share market

is not for everyone.

And it is foolish to

rush in under-prepared.

There is a serious risk of loss of

capital. |

NOTE: This check list will not guarantee your

success,

but it will help prepare you

for the road ahead.

|

Summary Check list

(A) Preparation - Important things to

think about (see details below)

- Why do this? Is this for your?

- Your suitability

- Psychology and emotions

- Risk tolerance

- Funds and funding (where will the money come from?)

- Fundamental analysis or Technical Analysis?

- Funda-Technical Analysis

- Share price trends - The trend is

your friend

- How much news?

- Trading Styles, Plans and Strategies

- Trading Styles

- Trading Plans

- Trading Strategy

- Nimble Short Term Investing

- Allocate time and time slots (ie. time management)

- Understand the market and the instrument

- Your stock universe

- Understand your opponent and the counter-party

- Understand the market rules

- Paperwork

- Trading practise

- Back testing

- Paper trading

- Education

- How to trade?

- Broker and Trading Account

- Charting software

- Computer hardware

- Review

- Risk and money management

- Position sizing and position size

calculator

- Exit strategies

- Stop Loss

- Portfolio management

- Risk management

- More information...

(D) Trading - "pulling the trigger" (see

details

below)

- Trade planning

- Logon, select and trade

- Keep good records

- Be aware of and manage the emotions

(E) Trade Management - Monitor progress (see

details below)

- Monitor positions

- Periodic review of positions

- Scale down a position

- Periodic strategy review

(F) Investing / Trading Strategies (see

details below)

- Strategy considerations

- Sample strategies

See all the details below...

|

* Notes

and More Info

Many of the topics listed at left are expanded in Brainy's series

of eBook

(PDF)

Articles on Share Trading / Investing (see the list in

the left hand column).

Toolbox Members

- have access to the contents of the Share Market Toolbox. Some

materials are free; but much is reserved for subscribing Members.

More

details...

Robert

Brain provides support to new and

experienced traders and investors, including charting

software.

Why "Brainy"?

"I need to

differentiate myself and my products and services from

others in the

market place. So I am using one of the nicknames I had in

High School."

Who

is Robert Brain?

Brainy's

eBook

Articles

are fantastic value for money (free access included with

Toolbox Membership):

- The amount of information delivered each month is

just enough to easily digest without suffering information

overload.

- Better than buying another text book that you might

struggle to find time to read.

- File the information for easy future reference.

- If you have a special topic that you would like

covered, just email a request to Robert and maybe it can be

included.

Robert also runs seminars:

The toolbox is an arsenal

of weapons to help you tackle the share market.

See a list of contents on

the Toolbox

Gateway page.

The

Share Market

- more information about the market and investing and trading.

And whatever you do,

beware

the sharks in the ocean!

|

(A)

Preparation - Important things

to think about

- Why do this? Is this for you? - Think

seriously about why you might want to do this. Possible

reasons

include: taking

control, for enjoyment, to increase income, to build wealth,

etc. Or

perhaps just as a hobby for pocket money.

How seriously will you treat

it? The Australian Taxation Office has strong views about

the

degree of

seriousness.

See Brainy's eBook Article

ST-2000, "Preparation"

for an introduction to this topic (it's free), and

Article ST-2100, "Why

get into Share Trading?"

for some more details

[Toolbox members* can see the full version of ST-2100 here.]

- Your suitability

Find out

if you are suited to share market investing/trading - whether

short

term trading or

long-term investing. Some people have problems with the

worry of committing money to the share market. But there are

simple

ways to overcome this, such as keeping the amount of money "at

risk"

relatively

small (proper money management - see below). It is possible to

sleep at

night.

- Psychology and emotions

Understand the emotions and

psychology involved with this activity to help you stay in

control of your emotions whilst trading. The experts say that

a sound

psychological approach is about 80% of the

challenge in achieving success. There are strategies that can

be

implemented to help calm the nerves, stay in control, sleep at

night,

and protect investment capital. Read more about the underlying

emotions

and

psychology of the markets on this Toolbox web page on Emotions and

psychology.

Also see the "Risk

and money management" notes below.

A good book on this subject is

Mark

Whistler's "Trade with Passion and Purpose"

(picture at right).

Also see Brainy's eBook Article

ST-2120, "Psychology and emotions.

[Toolbox members* see the full version of ST-2120 here.]

- Risk tolerance

It is

very useful to understand your risk tolerance.

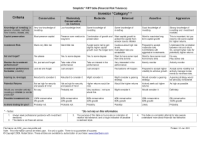

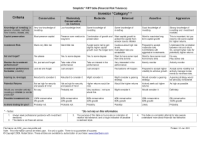

Robert has included a

self-assessment Financial Risk Tolerance table (FiRT)

in eBook Article

ST-2180, "Your risk profile and

tolerance".

[Toolbox members* see the full version of ST-2180 here.]

- Funds and funding

It is important to understand where the investing/trading

funds will

come from, and

if there is any limit on the funds, and the costs associated

with any

borrowings.

- Fundamental or Technical Analysis?

|

Don't

forget:

Price charts summarise the underlying

opinions and emotions of the market participants.

Every chart tells a story.

It pays to understand the stories in the price charts.

(technical

analysis helps us read the charts) |

Understand the difference between fundamental

analysis and technical

analysis, and

understand your own preferred position. That is, do you

want

to follow

just one of these approaches 100%? Or maybe a bit of both? If

you want

to follow technical analysis, consider Brainy's

Technical Analysis Intro seminar, or consider joining

the ATAA

(Australian Technical Analysts Association).

Funda-Technical

Analysis Funda-Technical

Analysis

The Funda-Technical

Analysis approach

is a special blend of both the fundamental and technical

analysis

approaches.

It utilises just three key fundamental analysis criteria to

develop a

watchlist of quality stocks, and then technical analysis to

time the

investment

entry and exit for optimum benefit and profits. Read more

about Funda-Technical

Analysis, and

see Article ST-2300, "Funda-Technical

Analysis"

[Toolbox members* see the full version of ST-2300 here.]

Trends - The trend

is your friend Trends - The trend

is your friend

Understand the concept

of share market price chart trends

(ie. uptrends and down trends) using Brainy's unique "3Ways

Rule" to help

understand the key characteristics.

Also see detailed information on trends

(a Toolbox web page),

and the related topic of Dow

Theory (also the Article TA-2200, "Dow

Theory"

- and Toolbox members see the full version of TA-2200 here).

Don't forget a couple of very important points about trends -

once a

price trend is confirmed (either up or down) then it is likely

to

continue, and a trend is in place until it is confirmed to

have

finished (see Dow Theory for more details).

- How much news?

Think

about how much news you want to see and hear, to help you with

stock

selection. Some people ignore most of the news, whilst others

spend

many hours studying the news. Some people follow the news

because they

enjoy it, even if it

doesn't help much. Also see the Toolbox web page Balance

the time on research and investing.

- Trading

Styles,

Plans and Strategies

Understand the difference between each of these ideas. Much

has been

written on this topic, and many people have different

understandings of

what they are. After consulting with experts, Robert has

clearly

described how the notion of trading

styles is rather different to trading

plans, and

also different to

trading

strategies.

See the free eBook Article ST-2400, "Trading Styles,

Plans, Strategies" for an overview and

explanation.

- Trading Styles

Understand your preferred style (intraday trader, short term

trader,

longer term trader, or investor).

See eBook Article ST-2410, "Trading Styles"

for a discussion.

[Toolbox members see the

full version of ST-2410 here.]

- Trading

Plan

Write out

a trading plan to describe "what" you want to invest in (eg.

shares,

CFDs, currencies, foreign exchange) and over what time

frames (short

periods, long periods).

See eBook Article ST-2420, "Trading Plans

and Template"

for a discussion.

[Toolbox members see the

full version of ST-2420 here.]

Trading

Strategy Trading

Strategy

Write

out your intended trading strategy - ie. the stock selection

criteria,

the entry signals, the exit criteria. Also your money

management,

portfolio management and risk management strategies

(including

stop-loss determination method). BUT, there is an assumption

here that

you understand enough about stock selection criteria.

It is possible

that you might need to learn more about Technical

Analysis methods.

See eBook Article ST-2430, "Trading

Strategies and Template"

for a discussion.

[Toolbox members see the

full version of ST-2430 here.]

- Nimble

Short Term Investing

The

Nimble Short Term Investing approach was pulled together (by

Robert

Brain) in 2014, and pondering many investing and trading

issues for

quite some time. There is no suggestion that the approach is a

winner,

and there is no suggestion that any one should adopt it. And

it is

possible that some of the finance industry professionals might

not like

some of the details.

See

more details about the Nimble Short Term Investing approach.

- Allocate time and time slots

|

A

note on

allocating time

The time to spend can be apportioned across

each of the following areas:

- Research time,

- Stock selection time,

- Optimising the entry,

- Managing the position,

- Monitoring all open positions,

- Managing the exit.

|

|

Why

do people

spend

so much time on it?

Different people will spend different amounts of time

on each of the

above aspects. Why?

Simple

- It's because they enjoy the activity. It's almost

like a favourite

hobby. For them, the journey itself is enjoyable.

See a discussion on this on the Toolbox web page Balance

the time on research and investing. |

One of the biggest

downfalls for many

new-comers is that they don't treat this activity seriously,

and they

don't allocate the time that it deserves. But the amount of

time is not

as important as having a routine.

The routine might be a specific

couple of hours on a certain day once each week, or it might

be more or

less often.

The important

point is that we need to be able to take advantage of market

opportunities as they arise, but more importantly we need to

know

whether our position is in profit or loss, and to exit our

position if

needed.

Without a regular (perhaps weekly) routine to do this, we

might be

throwing our money away.

- Understand the market and the instrument

You need to understand the market and instrument that you want

to

trade. It might be real shares on the share market, or CFDs on

shares

in the share market, or the currency markets (forex), or

options or

warrants on the share market. Or it might be the SPI (Share

Price

Index). It is

dangerous to play any game without knowing the rules.

See Article ST-2500 "Understanding

Share

Prices" (Toolbox member full version here.)

Perhaps study a

training course or seminar (eg. Brainy's

Share Market Secrets 101 seminar (aka Boot Camp).

- Your

"stock universe"

To

help increase the chance of success, and to stay focused,

there are a

number of considerations regarding your "stocks universe". If

you

choose to invest in Australian equities (ie. the share

market), then it

can be useful to narrow down the range of stocks in which you

might

invest. For example, you might choose to focus on any one of

the

following groups, or more than one of these groups (and see

more information on the "Your stock universe" web page):-

- Top 200 stocks - The XJO index (S&P/ASX

200).

- Top 500 stocks - The All Ordinaries index (XAO).

- The stocks in the mid-cap 50 index.

- The stocks in the Small Ordinaries index.

- The stocks in a particular sector (eg. financials,

health care, telecommunication stocks, etc.).

- Stock liquidity (see more details

here).

- And there are many other groupings to think about.

- Understand

your opponent and the counter-party

It

is very useful to understand as much as you can about the

other players

in the market - who are they? how big is their pocket? and

what rules

do they play by? You might be

surprised at how easy it is for a novice to come unstuck very

quickly

because some of the players bend the rules and don't play

fair. Don't

forget that there is always a counter-party on the other side

of your

trade, and it can be useful to understand who that might be.

- Understand

the market rules

It

is very useful to understand the rules for playing the game in

your

chosen market. And after understanding the rules, then realise

that

sometimes, some of these rules are bent by some of the

players. And

sometimes they get caught and punished, and sometimes they

don't. Just

because there are road rules that we are meant to obey on the

roads

(like speed limits, and obeying traffic lights and turn

signals),

doesn't mean that everyone abides by all the rules all of the

time.

|

(B)

Get ready

- Paperwork

It is very

important to have the appropriate paperwork ready to record

useful

information about your investing / trading activity. This

might be a

simple spread sheet to record the details of each buy and sell

transaction, with some way to track your overall results -

win/loss

ratio, average win size, average loss size, total profit (or

loss),

etc,. etc. It is important to give some thought to how you

might do

this. See more information below

about Trading Journals

and a Trading Diary.

- Trading practise

It

is important to practise before starting to trade for real.

This will

help to test out the emotions, as well as the strategy and the

recording paperwork. The practise might be back testing (see

items below), or a share market game like the twice yearly ASX

share market game. Also see Article ST-3100, "Trading

Practise"

[Toolbox members see the full article here].

- Back

testing

To gain

confidence with your documented trading strategy, it is very

wise to

test it out on past history. You could use the TradeSim

software to do this (with BullCharts).

Paper

trading Paper

trading

Now that

you have some confidence with your trading strategy, test it

for real

by "paper trading". That is, go through the motions of

identifying stocks to trade, and hypothetically place your

trade by

recording your hypothetical trade details on paper (or in

the

computer), then at some future time, exit the trade and

record the

details. Monitor your success over a period of time (weeks

or months)

to gain more confidence that your strategy actually works.

See more

details about Paper Trading.

- Education

Identify any

missing knowledge or skill, and seek to address this. Join an

organisation of like-minded people to network with others and

to share

ideas and learn

from their experiences

(eg. the Australian

Technical

Analysts Association - ATAA).

- How to trade?

Determine whether you want to use a full-service broker to

give you

guidance and advice, or an online broker with no advice, or

somewhere

in between.

- Broker and Trading Account

Find an appropriate broker and/or service provider, and sign

up for a

trading

account.

- Charting software

To effectively

select quality stocks, and properly time the entry, you really

need

good quality charting software. This author prefers the

Australian BullCharts

charting software (and

as an authorised re-reseller can offer a

good deal). Many people find that a second computer monitor

can be

useful.

- Computer hardware

Provided we have a reliable internet

connection, we don't really need anything special to manage

our own

trades, unless we are serious enough to want to trade

intraday utilising current data. This might include a

"trading

platform" with specialised software (eg. WebIRESS which is offered by a

number of brokers), running on a computer with enough grunt to

perform

adequately.

- Review your

"ShareMarketReady" checklist (this web page) to see if you are

ready.

(C)

Risk and money management

- Risk and money management

Make sure you implement sound money and risk

management strategies.

If

investing / trading in stocks, consider preparing a watchlist

of only

quality companies in order to increase the chances of success

- avoid

high-debt companies and those with a history of poor

performance. Also

see

the "Managing

Risk" presentation), and the Toolbox web page Risk

management, and the following

eBook (PDF) Articles:

- Position

Sizing and Position Size Calculator

In

order to maximise the effectiveness of your trading, it is

important to

optimise the size of each trading position. That is, to

maximise your profits on winning trades, you should take out

the

largest possible position that your strategy and risk

management will

allow (perhaps up to a degree). Otherwise, your profits will

be smaller

than they could

be. And with proper money and risk management, the losses

should be no larger.

Some

simplistic research has shown that a position size needs to be

at least

about $1500 to $2000 in size, otherwise a modest amount of

brokerage

will take too large a bite out of the capital.

See the Toolbox web page on Optimising

position size.

See eBook Article ST-4400, "Position Sizing"

for details about position sizing.

[Toolbox members see the

full version of ST-4400 here.]

Exit

strategies Exit

strategies

It

is very important to have a plan regarding the possible exit

conditions

from a position. That is, what condition might trigger the

action to

sell part or all of a position? It could be any of the

following, for

example:- little price movement over a specific time period

(known as a

Time-based Stop); a weakening uptrend; a failure of an

uptrend; two

moving averages cross; a chart indicator shows weakening (eg.

RSI,

MACD, ADX, etc.); or a Stop Loss is triggered. See the

free

eBook Article TA-6030, "Exit strategies - Introduction",

and the Toolbox

web

page. Also, more details in the October 2013 monthly eNews email.

- Stop

Loss

If we want to limit our losses, and avoid the sometimes

catastrophic

falls in share prices, then it is vitally important to have a

Stop Loss

position determined for every position, and to action our stop

loss as

appropriate.

It

is customary to have an Initial Stop Loss to protect the

position until

it moves into profit, and then a Trailing Stop Loss that will

be moved

progressively higher to protect the accumulating profit as the

share

price moves higher.

See some initial information on the Toolbox Stop Loss

web page.

See Robert's eBook Article ST-4500, "Stop Loss"

for more details about that all important concept - the humble

Stop

Loss.

[Toolbox members see the

full version of ST-4500 here.]

- Portfolio management

Make sure to have a good way to record your trades and your

portfolio

positions.

- Risk

management

Be

sure to think through those things that could go wrong with

the

investing or trading activities - ie. have a "Plan B" ready.

Things

like a broken computer (power goes off, or internet goes

down). It will

be useful to have an alternate method for placing trades. This

might be

a laptop computer (with battery fully charged) and a separate

mobile

internet connection. Also a printed sheet of instructions, and

broker

phone number details, so that positions can be closed manually

by phone

without using a computer. If you do a serious risk analysis,

you might

ask yourself "what's the worst thing that can go wrong?". And

then

consider both the likelihood of each risk event, and the

seriousness of

the risk event if it does occur. Then work through the high

impact and

highly likely events and do something to mitigate the risk.

Then you

will be like a good Scout - Prepared.

- More information...

on these

topics is included in Brainy's eBook (PDF) Articles on Share

Trading - see

them

listed in the left-hand column on this web page (eBook

Articles

Table of Contents).... Also see: the archived

Monthly Toolbox eNews emails.

(D)

Trading -

"pulling the trigger"

- Trade

planning

Give careful consideration to any pending investment. This can

include

things like:

- The amount of possible Reward versus the Risk

(and the

Reward to

Risk Ratio).

- Using a Trade

Planning work sheet or calculator

to quickly consider different position size scenarios.

- The percentage amount of capital to be deployed,

and at risk

(see item above).

See Robert's eBook Article ST-5110, "Trade Planning"

for more information and tips regarding planning the trade.

[Toolbox members see the

full version of ST-5110 here.]

Logon, select, and trade

Logon, select, and trade

Proceed with caution.

- Keep

good records

It is vitally important to keep adequate records of all

transactions.

This might be for tax purposes, but also to enable a sound

periodic

review of performance to determine whether the strategy needs

to be

refined.

See Robert's eBook Article ST-5210, "Trading Journal

and Trading Diary"

for details about Trading Journals and Diaries. [Toolbox

members see

the

full version of ST-5210 here.]

- Manage the emotions

Be mindful

of the sweaty

palms and pumping

heart on your first few trades.

Not

able to sleep at night in case something goes wrong? Perhaps

the

position size is too large. Go back to the discussion above

about risk

management and reduce the position size to be a smaller

portion of the

overall capital (but remember to keep it large enough so that

the

brokerage fees don't kill it). Also see the Toolbox web

page Emotion and

psychology of the markets.

(E)

Trade Management - Monitor the positions and progress

reviews

- Monitor positions

Monitor and review open positions, and close out appropriate

positions

(ie. implement the Exit

Strategy when appropriate),

on a periodic basis according to your trading strategy. This

is

critical, in case the position is moving against you and you

ought to

consider closing the position. This might be on a daily basis,

or every

couple of days, or perhaps weekly. It needs to be thought

about, and

acted upon - rigorously.

- Periodic review of

positions

According to your trading strategy, review

your open positions and make adjustments as appropriate.

- Scale down a position

If a position has experienced significant growth, and is now a

much

greater value than when purchased, it might be over-weight in

the

portfolio. In which case it might be appropriate to sell a

portion in

order to bring the portfolio back towards a more balanced

situation.

- Periodic strategy review

According to your trading strategy, review both open and

closed

positions (ie. overall progress), and make any necessary

adjustments to

your trading plan and strategy.

(F) Investing /

Trading Strategies

For information on investing/trading strategies including some

concepts, some considerations, and some sample strategies

including

those listed below, with more details and lots of sample

strategies in

Brainy's eBook

(PDF) Articles on Share Trading

/ Investing (in the left-hand column, numbered ST-6xxx).

- Strategy considerations:

- Volume and

stock liquidity

- Finding

liquid stocks

- GICS Codes,

indexes and sectors

- Sample Strategies

- Break outs

- Correlation

- Robert

Weekly Watchlist

- Robert's

JB+AH Strategy

- Stan

Weinstein

- Alan Hull

- Daryl Guppy

- Nicolas

Darvas "How I made $2 million on the Stock Market".

WARNING:

Investing

in the share market does

expose you to the risk of financial ruin.

If

you proceed, please do so carefully.

Beware

the sharks in the ocean.

|

Before you start investing

in the share market or share

trading, it is wise to adequately prepare.

Before you start investing

in the share market or share

trading, it is wise to adequately prepare.

Trading

Strategy

Trading

Strategy

Logon, select, and trade

Logon, select, and trade