What does blue chip really

mean?

The ASX web site currently (post-GFC)

defines blue

chip as follows:

"Larger companies with a long

history of profitability and stability."

The ASX revises this definition from time to time (this

version is different to the one that was posted on the web in 2008).

But what does this really mean? Let's take a look at the definition in

detail.

"Larger companies..." -

Okay, so blue chip companies are larger.

But larger than what? We could look at the definitions for "large cap"

companies versus "medium cap" or "small cap" companies, but there is no

standard

definition for this. There isn't a list of "larger" companies. So this

is a very subjective description. If we prepared a list of all

companies, and sorted it by market cap, where would we draw the line to

distinguish large caps from medium caps?

"...long history..." -

The blue chip companies have a long history.

Well, how long is "long" - is it just a few years? or ten years? or

longer?

"...profitability..." -

So, how do we define profitability?

Is this the amount of profit after tax? Or perhaps profit before tax

(EBIT)? What

about the Return on Funds? ROE (return on equity)? or ROSF (return on

shareholder funds)? Or what? And to what degree are they profitable? If

we look at ROE, for instance, do we want to see a 10 percent Return on

Equity over just three years? or maybe over 5 years? or 10 years?

"...stability..." - How

on earth do we define stability?

So, we can see that this definition of blue chip is very

vague, and it doesn't really tell us anything substantive about a

company that is labelled as a blue

chip.

Does this really matter?

We are told that it is good to have blue chip

companies in our portfolios.

Lots of people talk about blue

chip companies.

Lots of investors have so-called blue chip companies in their

portfolios.

Our broker or financial advisor might recommend that we include blue

chip stocks in our investment portfolio. So, how do we find

out which stocks are blue chip?

Try this - Ask your broker or adviser for a list of blue chip stocks.

They probably won't

provide one - because there isn't one.

If they do give you one, ask them what qualifies a company to appear on

their list.

And if they do give you a list, it might be similar to a list from

another source, but it probably won't be identical.

How did the term blue

chip come about? How did the term blue

chip come about?

Well,

many years ago, the blue coloured chip in the casino was the most

highly valued chip of all. And so this label was applied to companies

that were considered to be highly valued.

(BTW - These days the blue chip still is the most highly

valued in some casinos, but

not in all casinos.)

Blue chip stocks can be disappointing!

Would it surprise you to hear that blue chip

stocks can be disappointing?

Their share price performance is not guaranteed.

If you want to see capital improvement, there are times when you might

be waiting quite

awhile.

It

only takes a common old bear market, or a severe market correction, to

highlight how poorly many blue chip stocks perform over the medium

term. If you invest for the very long term, then that might be a

different story. But for short-term capital profits we want to see

shares increase in value over several months, or at most a couple of

years.

During the infamous Global Financial Crisis (GFC - aka

Global Credit Crunch) of 2008, many blue chip stocks fell in value, and

by mid-2011 (when this web page was first posted) some 3 years later

many

of these blue chip stocks were

still well below their market peaks of 2007-2008. For anyone who is

trying to simply ride out this period of poor market performance, they

could have been waiting a long time.

Then there was the end of the resources boom which hit very hard in

2015, and resulted in a commodities downturn, and many mining and

resources stocks suffering sharp price declines.

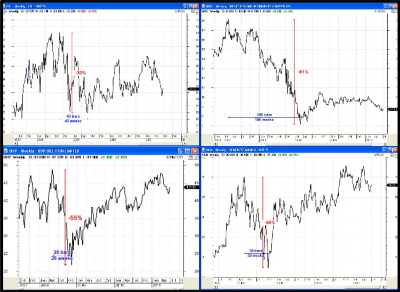

In the accompanying price charts

there are many examples of Australian blue chip companies that fell in

price during the GFC. Many of them fell a long way - in the order of 50

to 70 percent. Also included are other companies that suffered

surprising declines at various times

See the material below for details.

|

More information

See

more details about the blue chip stocks that have fallen at various

times (will prompt for Toolbox

member username and password):

Share Market

Terminology

See Brainy's eBook Articles, and the Master

Index list for details.

Or, search

the

eBook Articles.

Robert writes information from time to time about

the market and investing. If you are not a

Toolbox Member, you

can

register to receive useful free information as it is published.

Privacy ensured, unsubscribe anytime.

See

the Testimonials - the things that people say about the

Toolbox and more.

|

Robert

Brain provides various support to both new and

experienced traders and investors.

Who

is Robert Brain?

The toolbox is an arsenal

of weapons to help you tackle the share market.

See a list of contents on

the Toolbox

Gateway page.

The Share Market

- more information about the market and investing and trading.

BTW - Are you Share

Market Ready?

And whatever you do,

beware of the sharks in the ocean!

class="ht14"

|

Blue

chips falling...

|

BHP Billiton - Massive

disappointment

Who

would have thought that Australia's goliath stock BHP Billiton could

have suffered the share price decline that it experienced in 2015.

Could we have anticipated this? Well, perhaps we might not have

forecast that this cold happen; but the technical

analysts amongst us could have seen a down

trend developing, and protected our capital by closing the

position before it got drastic (perhaps by using the Stop Loss

approach).

See the next price chart below for more details.

|

|

BHP Billiton - protecting our

capital

We could have used key information in the price chart of BHP Billiton

to protect our precious investment capital from the sharp share price

slide from 2012 onwards.

The price chart at right includes some text to explain the concepts of

how we could use the price chart features to do this (Toolbox Members

click for a larger version).

|

|

Consumer Staple stocks are safe -

aren't they?

Now,

it's supposed to be a good idea to buy Consumer Staples stocks because

of their resilience in good times and bad. However, the price chart of

Woolworths (WOW) at right tells us otherwise.

|

|

The

details below talk about the blue chip stocks that fell

during the GFC. And the stocks in the right-hand column are

good examples of what can

happen to blue chip stocks at any time, not only during a GFC.

|

|

Blue

chips that fell more than 50% in GFC...

|

A number of Australia's blue chip stocks fell more than 50%

during the Global Financial Crisis (GFC) of 2008-2010+.

There are two sample stocks shown in the price charts at right:-

- AMP fell 64% in 78 weeks

- CBA fell 60% in 64 weeks

And at the time of writing this material (July 2011), these blue chip

stocks

were still under their highs of almost 3 years earlier.

Actually

there are quite a few blue chip stocks that fall into this

category, not just the two samples here. The collage of four stocks at

right are just four more examples of falling blue chips. These four

fell between 30% and 60% over periods between 26 and 106 weeks. At the

time of writing here, a couple of these are still well down, and a

couple are close to recovering to their past highs (after about 3

years!).

Which stocks are these four?

NOTE: For the purpose of studying "blue chip" stocks here, we are

looking

primarily at the Top 50 Australian stocks - the XFL

index (S&P/ASX

50). Also, there are probably a few more stocks that fall

into this category, and which are not listed here.

|

AMP

(click for a larger view) |

CBA

(click for a larger view) |

See

more in the Toolbox Member area.

Four more falling blue chips.

See these and more falling blue chips in

the Toolbox Member area. |

|

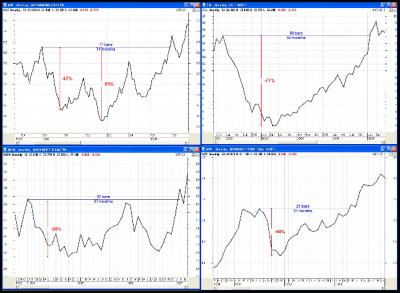

Blue

chips can remain below past highs...

|

Over the last 25 years or so a number of Australia's blue chip

stocks fell more by a large amount, and did not regain their old highs

for many months, or even for years!!

There are two samples at right:

- Westpac bank (WBC) fell 54% over a 4 year

period, and

took a total of 7 years before it made new highs and stumbled again the

following year.

- Telstra (TLS) is that one stock that has fallen

71% over 11+ years, and is still not looking like making new highs

anytime in the near future. Anyone who invested in the initial T1 float

has seen their capital destroyed. Likewise in both T2 and T3, even

after the government and some advisers and brokers recommended investor

partipication.

The

collage

view of four stocks at right shows just four more blue chip

stocks that fell a long way, and which took a long time to attain new

highs.

Which stocks are these four?

NOTE: For the purpose of studying "blue chip" stocks here, we are

looking

primarily at the Top 50 Australian stocks - the XFL

index (S&P/ASX

50). Also, there are probably a few more stocks that fall

into this category, and which are not listed here.

|

WBC

(click for a larger view) |

TLS

(click for a larger view) |

See

more in the Toolbox Member area.

Four more fallen blue chips that took a

while to recover.

See these and more that took a

while to recover in

the Toolbox Member area. |

|

|

class="ht14"

class="ht14"