Share Market Toolbox

(public information)

|

Brainy's Share Market Toolbox (public information) |

|

Weekly Watch List |

|

|

|||

| You are here: Share

Market Toolbox >

Share Market Analysis (overview)

> Weekly Watch List (public

information) Related links: Weekly Watch List (Premium Members information); Analysis overview (for members); Weekly Analysis (for members); Monthly Analysis (for members); |

Robert's Weekly Watch List (WWL) is a list of stocks from the XJO

index (S&P/ASX 200) which have their share price in an

uptrend, and the list is sorted into a particular sequence (based

on a complex set of technical analysis observations).

|

Weekly

Analysis and Update email

Robert also analyses the state of the Australian share market on a weekly basis, and shares the analysis with Toolbox subscribers in his Weekly Analysis and Update email. See more details here, and see recent analysis comments and overview charts are available here for public viewing. Toolbox Premium Members...

Premium Toolbox Members can see the latest Weekly Watch Lists here, as well as archived copies of past Watch Lists. And there is information about exactly how we choose the stocks for the Watch List, and what we do with the list now that we have it. Want to become a Member?

See the How-To-Join information with details about how to become a Toolbox Member. Non-Members...

Robert would be happy to occasionally send you the Weekly Market Analysis email with a summary of the latest Watch List details, or simply keep you informed of new information as it becomes available. For Email

Marketing you can trust

|

|||

|

||||

FAQ - Frequently Asked Questionsabout Robert's Weekly Watch List |

||

Is this advice? NO!

- This is definitely not advice of any sort. We do not have an AFS

License, nor does he take your personal financial situation into

consideration. So there is not way that this information can be

advice. NO!

- This is definitely not advice of any sort. We do not have an AFS

License, nor does he take your personal financial situation into

consideration. So there is not way that this information can be

advice.

This information is for education only. You should always seek suitable advice from |

||

CAUTION!!It can be said that any investing or trading strategy might be successful for one person, but not successful for another. This is due to a number of reasons, including one's own risk tolerance and psychological make-up. |

||

Is this a list of Hot Stock Tips?Robert's Weekly Watch List might look like a list of Hot Stocks, or it might look like a list of Stock Tips - what to buy and what to sell. But it is not this at all. Robert might treat the list in this way because it suits his purpose, his strategy, and his investing risk tolerance.So, what is the purpose?

Robert's Weekly Watch List is being shared as a sample application

of how to use technical analysis for selecting possible investment

opportunities. By following the links, and understanding the

concepts, we can see the investing and trading strategy being used.

|

||

Executive overview (ie. Brief summary)

|

||

Preferred stocks - Which stocks do we select from?For this "Weekly Watch List" strategy we are looking only at Australian listed companies. We want to minimise the risks - so we exclude speculative stocks. When we decide to exit a position, we will want to be able to exit the position quickly - so we will avoid illiquid stocks (ie. stocks which don't trade frequently enough, or which have very low turn-over). Stocks with relatively high debt levels have a greater risk of defaulting on their debt when times are tough - so we will avoid these stocks as well.For now, the simplest way to achieve all the above is to use the stocks that are included in a major index like the S&P/ASX 200 (ie. the XJO). For a longer list of stocks we could apply Funda-Technical Analysis and select from all stocks. [By the way - Which stocks are in the XJO index?] |

||

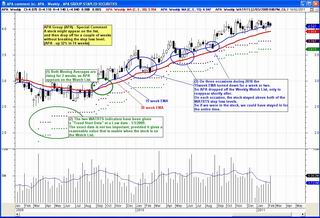

Selection criteria - Rising Trend and Moving Averages The criteria that

we use here to put a stock onto the Weekly Watch List is

based on the notion of a rising Moving

Average. This is one way to quickly spot a rising trend

- more details on trend-spotting

here. In fact, for this strategy we look for two Moving

Averages to both be rising for 3 weeks. The sample chart at right is

a lovely example of a healthy rising trend (click on the image for a

larger version in a new window). Note how much this share has risen

in price, and over what time period - not bad. The criteria that

we use here to put a stock onto the Weekly Watch List is

based on the notion of a rising Moving

Average. This is one way to quickly spot a rising trend

- more details on trend-spotting

here. In fact, for this strategy we look for two Moving

Averages to both be rising for 3 weeks. The sample chart at right is

a lovely example of a healthy rising trend (click on the image for a

larger version in a new window). Note how much this share has risen

in price, and over what time period - not bad. But which two Moving Averages do we use? - See the details in the Premium Member section of the Toolbox. |

||

Trends - "The Trend is Your Friend"

See Brainy's "3Ways Rule (in 3Times)" for information about trends, as well as more details on the Trends page. |

||

The ScoreEach of the stocks that is chosen to be included on the Weekly Watch List is allocated a Score. This score is calculated as a part of the BullCharts scan, using the BullScan criteria, and each scan criteria is assigned a "weighting". A stock that meets all criteria ends up with a "Score" of 100 out of 100. If a stock does not meet some of the criteria, it's "Score" will be less than 100. If a stock meets none of the criteria, then it is not on the list at all.All of the stocks on the WWL table are sorted with the highest score value at the top, and any stocks with an identical store value are then sorted into alphabetic order based on their security code (the ASX code).l The details of these scan criteria and the score calculation are available to Toolbox Premium Members here. There are some clues in the next section below "Tell me more about...". Note that the calculation of the Score value was revised in March 2017 after months of review and testing, and now provides a more accurate indication of the technical analysis interpretations. After watching and studying the revised score calculation method, it is apparent that any stock with a score of less than 50 is showing a lot of price weakness on the chart, whilst stocks with a score value of 50 or more are showing a tendency to share price strength. The maximum score value seems to be 80 out of a possible 100. |

||

What do we do next?Okay, so we have the Weekly Watch List (WWL) table, with a list of stocks sorted by a "score" value, so what do we do next?. Based on experience, and lots of chart eye-balling, it seems as though we then need to eye-ball the stocks with the highest score value, in order to weed out current price weakness that is not reflected in the score value. |

||

Tell me more about this Investing and Trading StrategyThe complete and detailed Investing and Trading Strategy that Robert uses with this Watch List approach is explained in detail across several of Brainy's eBook (PDF) Articles. Anyone can view the first page of each Article, but only Toolbox Members (and Premium Members ) can view the Articles in full. (And Robert actually has other strategies to suit different circumstances.)Relevant Articles and links for Toolbox Members (non-Members can see the "Page1" items):

|

||

Is this information reliable? Has it been tested?A specific stock selection strategy has been used to identify the stocks to appear on this Weekly Watch List. This strategy has been back-tested using BullCharts and TradeSim over specific date ranges. However, there are two difficulties with back testing this specific approach.Firstly, by utilising the Wilson ATR Trailing Stop, it is necessary to manually identify the start of each trend, so as to determine the stop loss values. This makes the back testing very difficult over more than very short time periods. Secondly, the manual experience of eye-balling the price charts has suggested that a degree of discretion is needed to optimise the stock selection before an entry is made. We are still struggling with this issue. To address this, either manual back-testing or some detailed paper trading is required. |

||

Please send me the Weekly Watch List each weekWe are happy to send you the Weekly Market Analysis email each Saturday, which includes relevant comments and the links to the latest Weekly Watch List table.To get this, all you need to do is subscribe to Brainy's Share Market Toolbox as a Premium Toolbox Member - more details are here. See the How-To-Join information with details about how to become a Toolbox Member. Not convinced about Toolbox membership? See the reasons why you should join. |

||

How is the Watch List information prepared?The market is scanned using the BullScan tool with specified selection criteria, and price charts with indicators are viewed using the BullCharts software as required. |

||

The columns in the table?The columns in the table include (updated June 2015):

|

||

The sort sequence for the rows in the table?

The rows in the table are firstly grouped into two categories: |

||

|

What? Some of these stocks are losers?  Remember,

whenever

stocks drop off the Weekly Watch List it does not mean that they

should be sold (if owned). Remember the criteria for entry onto

the list (two rising Moving Averages), and our own Trading Strategy

criteria for selling the stock. If we view the charts for the stocks

that have gone off the list recently, there are usually some that

fall and eventually trigger the Stop Loss,

while others eventually rise again. One way to help explain this

situation is to see the sample chart at right (click for a

larger image) of APA. We should always compare the latest share

price with our pre-determined Stop Loss level and sell if the Stop

has been breached, and continue to monitor in coming weeks. Remember,

whenever

stocks drop off the Weekly Watch List it does not mean that they

should be sold (if owned). Remember the criteria for entry onto

the list (two rising Moving Averages), and our own Trading Strategy

criteria for selling the stock. If we view the charts for the stocks

that have gone off the list recently, there are usually some that

fall and eventually trigger the Stop Loss,

while others eventually rise again. One way to help explain this

situation is to see the sample chart at right (click for a

larger image) of APA. We should always compare the latest share

price with our pre-determined Stop Loss level and sell if the Stop

has been breached, and continue to monitor in coming weeks. Also, it's important to remember that some of the stocks on the Watch List will lose money (fall quickly before triggering the stop and realising the sale). That's one of the facts about investing and trading. BUT, with proper "money management" our portfolio can still come out in front!! This is because if we cut our losses short, and let our profits run, then the accumulated profits should be greater than our losses. Even if we have a win to loss ratio of 50%! That is, if we have 5 wins and 5 losses, we can come out ahead provided our profits are larger than our losses. |

||

|

Why is a stock "off the list" if the WATRTS is not broken? Our selection criteria says that to be "on the list" a stock must have two specific moving averages increasing for the last three weeks. Now, it is possible for one of these moving averages to stop increasing for a week or two, because the share price is taking a "breather"; but for the price to stay above our Stop Loss level (the Wilson ATR Trailing Stop). And the price can then continue to rise, and cause both moving averages to rise again.So, why don't we fiddle with the selection criteria to keep these on the list? There are two reasons: The stock might be showing early signs of weakness, in which case we can monitor the stock and be on guard in case of a pending fall. Secondly, a temporary sign of price weakness might be an opportunity to enter the stock again at a cheap price. |

||

|

Some stocks on the list do nothing for the first few weeks - Why? This observation is a common occurrence with stocks that break out above resistance, of from a recent trading range. It can often be seen in different time periods (on daily charts, or weekly). The stock breaks out, but some people want to recoup their investment at these recently high prices so they sell, and with the excess of sellers in the market the price falls away. But once these sellers are gone from the market, then only the buyers are left to take the stock on to higher highs.When they fall, the stock can even fall lower than anticipated; but it can stop falling at a recent support level which might be the bottom of a recent trading range. A picture tells a thousand words, and this is one it is useful to view the price chart. This process can take several weeks to unfold. |

||

|

Graph of the number of stocks on the list

|

||

Toolbox

Members area? Toolbox

Members area?More information about the TOOLBOX MEMBERS AREA. Weekly Watch List information for Premium Members |

The information presented herein represents the opinions

of the web page content owner, and

are not recommendations or endorsements of any product, method, strategy,

etc.

For financial advice, a professional and licensed financial advisor should

be engaged.