Price action context — a definition:

The study of share market price action in conjunction with other

relevant information such as:

- the price action in previous days or weeks (or months or

more), and

- technical analysis chart features (eg. patterns, support,

resistance, etc.); and

- looking at other time periods, and

- looking at relevant news and announcements.

|

How to learn more

about technical analysis?

Technical

Analysis - Getting Started - Robert's suggested

steps on how to make progress with learning about

Technical Analysis.

More information

Funda-Technical

Analysis - An investment and trading approach

utilising a sensible balance of both Technical Analysis

and Fundamental

Analysis. Funda-Technical

Analysis - An investment and trading approach

utilising a sensible balance of both Technical Analysis

and Fundamental

Analysis.

Brainy's

3Ways Rule - a smart way to understand

trends, and the importance of spotting trends. Brainy's

3Ways Rule - a smart way to understand

trends, and the importance of spotting trends.

Brainy's extensive list of eBook (PDF) Articles

on Technical Analysis and other topics.

Brainy's seminars on Technical Analysis and

other topics - click here for details...

A variety of publications on Technical Analysis and

related topics - click

here for details...

ATAA

Australian Technical Analysts Association

The ATAA is

Australia's pre-eminent not-for-profit organisation

regarding technical analysis. The ATAA is

Australia's pre-eminent not-for-profit organisation

regarding technical analysis.

Some of the experienced ATAA members have contributed to

regular articles in The

Age and Sydney

Morning Herald newspapers. Scanned copies of these articles are

available for perusal.

Robert is a member of the Australian Technical Analysts

Association (ATAA). He is (since 2009) also the

Melbourne Chapter Vice-President, and a director on the

national board. Robert endorses the ATAA as a worthy

not-for-profit association for people looking for

education, help and networking.

See more

information about the ATAA.

And whatever you do,

beware of the sharks in the ocean!

|

Exactly what is "price action context"?

It is not widely discussed, but this term actually means different

things to different people. Some brokers refer to it to help guide

the thinking of their clients and to encourage particular

strategies, especially for use with intraday trading, and also with

forex trading.

My own preferred definition here is of more use to the average

retail investor or trader in the share market, and considers several

aspects which can be described as follows, particularly for the

benefit of share traders who are short to medium term (ie. from a

few days to many weeks or a few months) and who utilise technical

analysis.

The observation of an odd

or unexpected

share price movement

which can actually be explained by

a company announcement or other news or

even the simple price chart.

Further to this:

- By all means look at a share price movement in the last day or

so, but also look at several recent days, and even weeks.

- If viewing a price chart, then make sure to look at another

time period as well. That is, if viewing a daily chart, then

also look at the weekly.

- It can be useful to look at recent news for the stock, as this

might explain the price behaviour.

- If looking at the price performance over a particular time

period, then also consider looking over a different time period.

Why is all this important?

Especially for the average retail investor and trader, this can be

very useful so as to avoid some of the possible pitfalls that await

the inexperienced (and the experienced), but more so so that you can

better understand the "bigger picture" (remember that the market is like an elephant). Things like the

actual share price trend which might not be apparent from the price

chart you are looking at. Or change you view about whether the

latest large volatile move was random, or could have been

anticipated.

When a technical analyst studies the price charts in order to make a

judgement call about the likelihood of future price behaviour, we

need to remember that the price action can be influenced by new

news, or a company announcement. Once this new news becomes known,

then other investors in the stock will adjust their opinion about

fair value, and in turn this might result in additional buying or

selling of the security.

So when we study the price action, and try to understand why the

price did not behave as we thought it would, it can be very useful

to look at the context within which the share price is responding.

Problem #1 - The news media numbers

The first problem to be aware of here is that the news media are

very good at reporting today's share price movements, either of a

particular stock, or several stocks, or an index. In Australia, our

major TV stations do this routinely every day, and radio stations do

likewise.

The worst example of this is on Monday morning when the radio

announcers declare something like "...the Dow Jones

fell 700 points over night...". The first issue

here is that the Dow Jones index is based on stocks listed on the

New York Stock Exchange (NYSE) which trades until 4pm on Fridays.

And this coincides with 6am Melb/Sydney time Saturday (or 7am or

8am, depending on whether daylight savings is in place for either

the USA or Australia). So, when the Dow Jones reportedly fell 700

points, it was actually 2 days prior! The second problem here is

that it is much more useful to report such market moves in

percentage terms, and not in "points". If 700 points equates to just

1 per cent, then this is a quite acceptable amount. However, if it

is actually 5 per cent, say, then this is more significant.

Problem #2 - The news media headlines

Take a look at this typical example of sensationalising the numbers.

On 12 June 2020, one well respected newspaper and website reported

the following headline:

"ASX down 2.5pc for the week; $90b wiped in two day

sell-off". (See the online article here).

Wiping off $90 billion in a 2-day sell-off sounds somewhat alarmist

doesn't it? But this tiny amount is insignificant in many ways. This

is explained with the following examples and commentary.

Additional thoughts

- The daily or weekly traded volumes can also be very telling,

as per Dow Theory.

- If you are studying a price chart and cannot work out why a

share price has moved the way it has, take a look at the news

because very often the news will help to explain it.

|

Case study example #1 - Coronavirus bear market of 2020

|

Markets down heavily with little warning

In February 2020 with little warning, many share markets

collapsed. In Australia, the All Ordinaries index (XAO) fell

37 percent over just 4 weeks. In this situation it was

fairly easy to understand the reasons why - provided we were

aware of the unfolding coronavirus situation. |

|

Case study example #2 - XAO index in June 2020

The following considers one specific example of the All

Ordinaries (XAO) index in June 2020. (Click on the price

charts for a larger version.)

|

Down heavily in just 2 days

In the daily candlestick price chart at right, the All

Ordinaries index (XAO) fell heavily in just 2 days to be

down 4.9 per cent. It actually fell on the following day as

well to take it down even further.

The news media made sensational headlines and announced the

huge dollar value that this fall represents. What they

didn't say is what is explained in the next block below. |

|

Index finishes up in 2 weeks

Instead of looking at just the last 2 days of price action

(above), we could step back a little and look at the last 2

weeks of price action as shown in the price chart at right.

Notice in this chart that the fall of 4.9 per cent is still

indicated on the chart, but when we zoom out on the chart we

can see that it is actually 1.5 per cent higher than several

days earlier, on Friday 29th May.

So, when we take the latest price action in the context of

the last 2 weeks, we can see it's not such a big deal. If

the index doesn't fall any further, then so what about the

latest fall? Could you call the new headline

over-sensationalising?

|

|

Index is actually up 30 percent!

Now zoom out the chart even further so that we can see at

least 12 weeks of price action, as shown in the price chart

at right.

Note the nice uptrend since the lows of 23rd March, and that

the index is actually up 30 per cent from those lows over a

period of 12 weeks. So it is very important to consider the

context within which the price action is taking place.

|

|

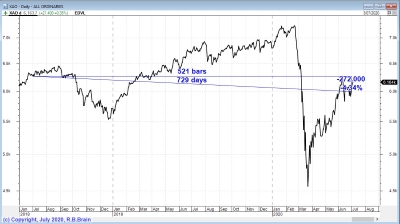

Index is still down 17 percent!

The next chart at right shows the same index but zoomed out

even further so as to see the all-time market highs of late

February 2020 before the global coronavirus pandemic caused

widespread shudders around the world, and impacted heavily

on economies and financial markets all around the world.

The reality as of 12 June 2020 was that the index might have

been up 30 percent from the March lows, but it was still

down 17 percent from the highs of February.

So we can see that looking at the bigger picture and being

cognisant of the recent price action is very valuable to

help keep everything in perspective. We call that price

action context.

A good argument could be made for paying more attention to

the business and finance news items, and even to browse the

market announcements that companies make to the stock

exchange. There could be a lot of useful explanation hidden

within those news items.

|

|

Case study example #3 - Superannuation performance for

FY20

The following considers the possible performance of a

"typical" superannuation fund for the financial year

2019-2020.

(Click on the price charts for a larger version.)

|

"Superannuation is down for the financial year just

ended"

This was the headline in some financial pages of the press

in the first few days of July 2020. Whenever someone writes

about the performance of superannuation funds, I find it

really difficult to comprehend. Because the many

superannuation funds and accounts are like a barrel full of

mixed fruit - they are potentially all rather different!

Anyway, if the average "balanced" super fund comprised a

large amount of share market stocks, then its performance

over the financial year might be a little like the

performance of our major market index over the same period.

And that is what's in the price chart at right.

This chart is a daily line chart of the All Ords (XAO) index

showing the performance from 1st July 2019 to 30th June 2020

- it was down 10.9 per cent.

But take a look at the way the index crashed part way along

the time period. It is actually up significantly from the

lows of March 2020. But for some people, that does not

matter. They need to report on the performance over a

specific time period.

|

|

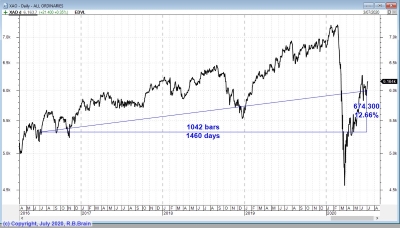

Which time period?

If we wanted to look at the performance of the market

(perhaps as an indication of how just a few super funds

might have performed), then let's look at the next chart at

right.

This is the same chart as above (a line chart of the XAO

index) but going back a further 12 months to start from 1st

July 2018.

Note that the market index was down 4.3 per cent over this 2

year period. That's still not very good is it?

|

|

Is there a better time period?

If we wanted to find a good looking set of numbers we could

zoom this chart out and look at a 4 year period from 1st

July 2016. Over this 4 year period the index was up 12.6 per

cent. Now that's a better number to look at!

Note: Always remember that zooming the chart out to like at

a bigger time period can be very useful. Remember that the market is like an elephant! |

|

|