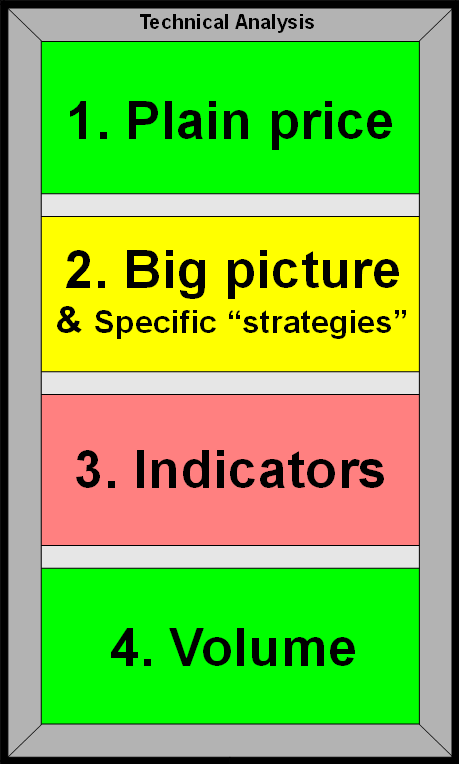

Overview - The "4 Windows" analysis method

Remember that the four windows that form the

basis

of this approach are:

Window 1 - Plain price - Trends,

Support, Resistance, and Chart Patterns

The uppermost window is to remind us that it is useful to

eye-ball the

plain price chart, and gain a quick feel for the presence (or absence)

of any

price

trend, any levels of support and resistance, and any chart

patterns.

Many successful traders and investors utilise only the concepts

depicted in this window, and they ignore the other three windows.

Window 2 - Big Picture &

perhaps your favourite "strategy"

The second window is to help fill out an

understanding of the "big picture". This can be done in a number of

ways, and may include your own preferred specific approach or favourite

strategy

(such as cycle analysis, Elliott Wave, or Gann).

Window 3 - Chart indicators

This window is to remind us that the subject of technical analysis

includes a range of chart indicators. Some people don't use

any

indicators because they

believe the plain price chart tells them everything. But many people

believe they can be very useful.

Window 4 - Volume

The bottom window is to remind us

that the consideration of volume can be important.

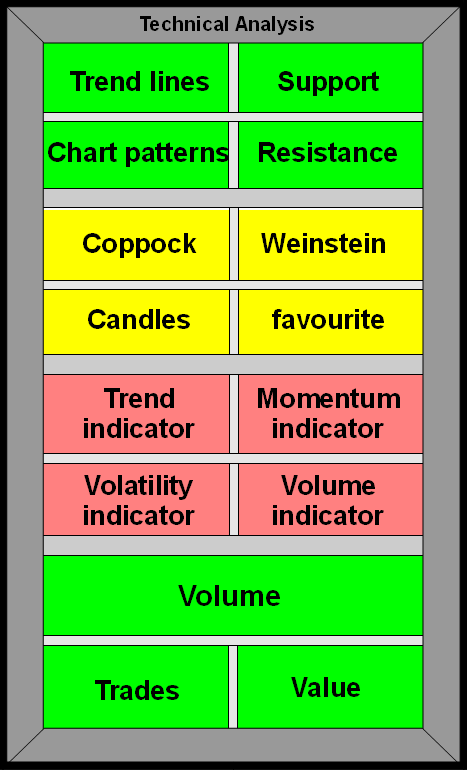

The upper three of the four windows can be

subdivided into four smaller windows, to remind us of the different

sub-topics

within each section. The detail is indicated diagrammatically

at right,

and explained in more detail below.

|

|

The "4

Windows"

analysis approach

|

The

details

|

|

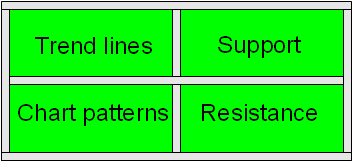

Window 1 - Plain price

The uppermost window actually contains

four sub-views, or four window panes.

This window and it's four window panes remind us

that it is useful

to eye-ball the price chart, and to look at the peaks and troughs in

price. If we can't immediately see the features, we can draw lines on

the chart to join together any successive

peaks, or successive troughs, and horizontal lines at the peaks and

troughs. Then any lines that don't make sense can be deleted. The end

result might be valid trend lines, levels of support and resistance,

and possibly a chart pattern (like a triangle, wedge, double top, etc.).

But what sort of chart should we use? - daily,

weekly, monthly?,

and a line chart or candles or bars?

The

first thing that is certain is to view at least two different time

frames, and possibly three (because the

market is like an elephant).

This might be to firstly view a monthly chart over several

years, then drill down to a shorter time period and view the weekly

chart,

and eventually view the daily chart. Remember that there might be an

uptrend in one time frame, and a downtrend in another time frame.

|

|

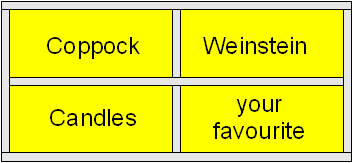

Window 2 - Big picture and your own

strategies

The second window is to point out two perhaps

different things.

Firstly, that sometimes there are specific tools or methods that can

help to understand the big picture. Secondly, that there are

some very specific approaches

(like Elliott Wave or Gann analysis) that some people find very useful

(for both big picture and shorter time frames). And it is most

important to zoom the chart out and view the longer time frames -

because the market is like an elephant.

The items

mentioned here are this commentator's own favourites:

- Coppock chart

indicator (on a monthly chart)

was designed to indicate turning points at market bottoms.

Weinstein

- In his well-regarded book "Secrets

for Profiting in Bull and Bear

Markets", Stan Weinstein describes his strategy of viewing

weekly price

charts, and a 30-week Moving Average, and to consider "Stage Analysis".

See more details here. Weinstein

- In his well-regarded book "Secrets

for Profiting in Bull and Bear

Markets", Stan Weinstein describes his strategy of viewing

weekly price

charts, and a 30-week Moving Average, and to consider "Stage Analysis".

See more details here.- Candlesticks

- The usefulness of studying candles, both individual candles and

multi-candle patterns, should not be overlooked.

See more details about candlesticks.

- Your favourite

- The fourth pane in this window is to remind us that we might find a

specific field of study useful, so we should keep our options open.

This includes the use of Elliott Wave analysis, as well as the studies

and ideas of Gann.

And don't forget - the

market is like an elephant, so always look

at a longer time frame as well. The extra insight can be surprising. And don't forget - the

market is like an elephant, so always look

at a longer time frame as well. The extra insight can be surprising.

|

|

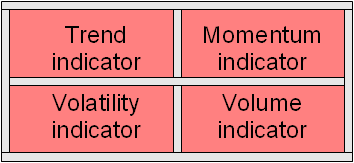

Window 3 - Chart indicators

The third window is all about technical

analysis chart indicators. This window also has four

window panes, to remind us that the

vast collection of chart indicators can be grouped

into four basic categories - trend indicators, momentum, volatility and

volume indicators. If we are keen to use one or more

indicators, then we

should consider an indicator from the separate groups - not all from

the one group.

Note that some people don't use any indicators

at all because they

believe the plain price chart tells them everything they need to know.

|

|

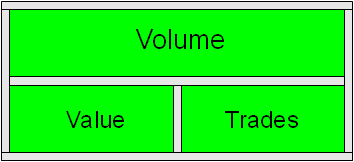

Window 4 - Volume

The bottom window is to remind us

that volume can be an important consideration, and that the volume pane

of the price chart ought

to be viewed.

Also,

this bottom window actually comprises three window panes, to remind us

that not only is the volume important, but for investors and traders it

is also very useful to understand the value traded per

day or week, and the number of trades

that takes place each day or week. These can help to make sure a

position size is not too large, and also to help make sure we invest in

stocks with enough liquidity to enable us to sell out quickly if

required.

|

|

|