Sharemarket candlestick price charts

The humble candlestick chart

can tell us a lot about the health, mood and

sentiment of

the market. The humble candlestick chart

can tell us a lot about the health, mood and

sentiment of

the market.

See Candlestick basics - The

basics of

how to interpret candlesticks (for relative

novices).

The sample candlestick chart at right is a simple short-term Daily

chart of BHP over a 6-day period in August 2008. Each candle on this chart summarises the price action in the trading of

BHP in each day.

After the normal to and fro of intraday share prices shown in the first three candles here, the fourth candle is almost a Doji candle,

indicating a lack of conviction to keep pushign prices higher. The next

candle is no higher than the Doji, so the market participants are

pausing to re-think the perceived value od BHP shares. That is, the

earlier uptrend is losing steam, and might be about to end. But the

very last candle is a bullish tall white indicating heavy buying

interest again.

Knowing how to read these simple candles can be so very useful in

gauging the mood and sentiment of the market. Candles tell us a whole

lot more about the market than the simple line

chart. They can help to identify likely turning points in a

stock or in the

market index.

See Candlestick basics - The

basics of

how to interpret candlesticks (for relative

novices).

What about bar charts? - See the discussion Candles or bars?

|

Candle

Pattern

Spotting - How to find which pattern

Here is a new approach to make

it easier for you to find your desired candlestick pattern:

- There

are many resources available that describe specific candlestick

patterns - provided you already know the name of the candle

pattern.

- The

biggest challenge for anyone new to candle-spotting is to firstly

recognise that one candle shape is meaningful, or that a couple of

adjacent candles can be a

meaningful candle pattern.

- The graphics here in the

Share

Market Toolbox will help you quickly spot a

pattern,

identify the name of the pattern, and then find further details for the

selected pattern.

- Because the material here is

laid out rather differently to most other candlestick resources, it is

reserved exclusively for Toolbox

Members.

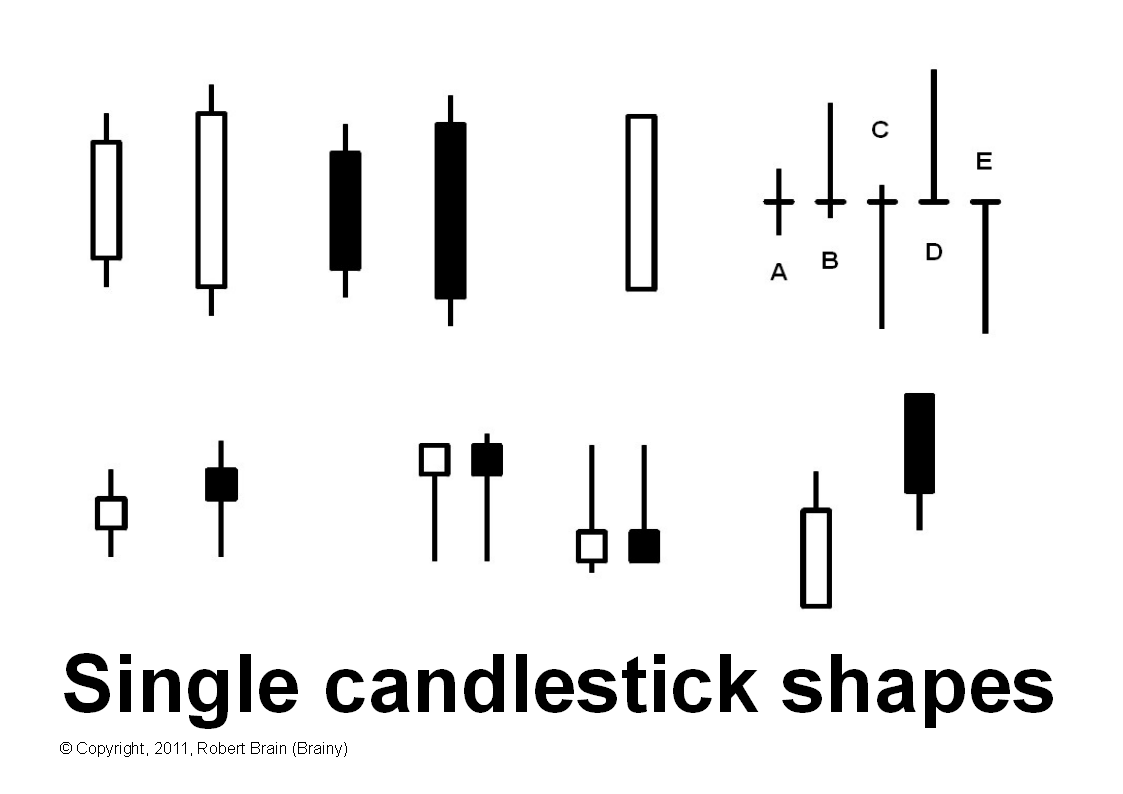

STEP 1 - Individual candle

features

Understand the key features to

look for in individual candles (below).

STEP 2 - The Trend?

On your price chart, are you looking at one or more candles that are:

STEP 3 - Identify the pattern

From

the concise list of relevant candle patterns, select the one that best

fits your pattern, and note the key comments such as:

- key pattern characteristics,

- similarities with other

patterns and why this is different, and

- psychology behind the pattern.

See the concise list of patterns in UP trends, or

the concise list of patterns in DOWN trends.

|

|

Quick Links

(public):

Candlestick basics - The basics of

how to interpret candlesticks

and candlestick charts (for relative

novices).

|

Quick Links (for Toolbox

Members):

Single

Candles

- White, Black, Big, small

- Marubozu

- Doji

- Spinning Top

- Hanging Man

- Hammer

- Shooting Star

- Belt Hold

See single

candle shape details in the Toolbox here, including the same

diagram with pattern names included.

Also see a description of the psychology at play on the Candle Features page.

|

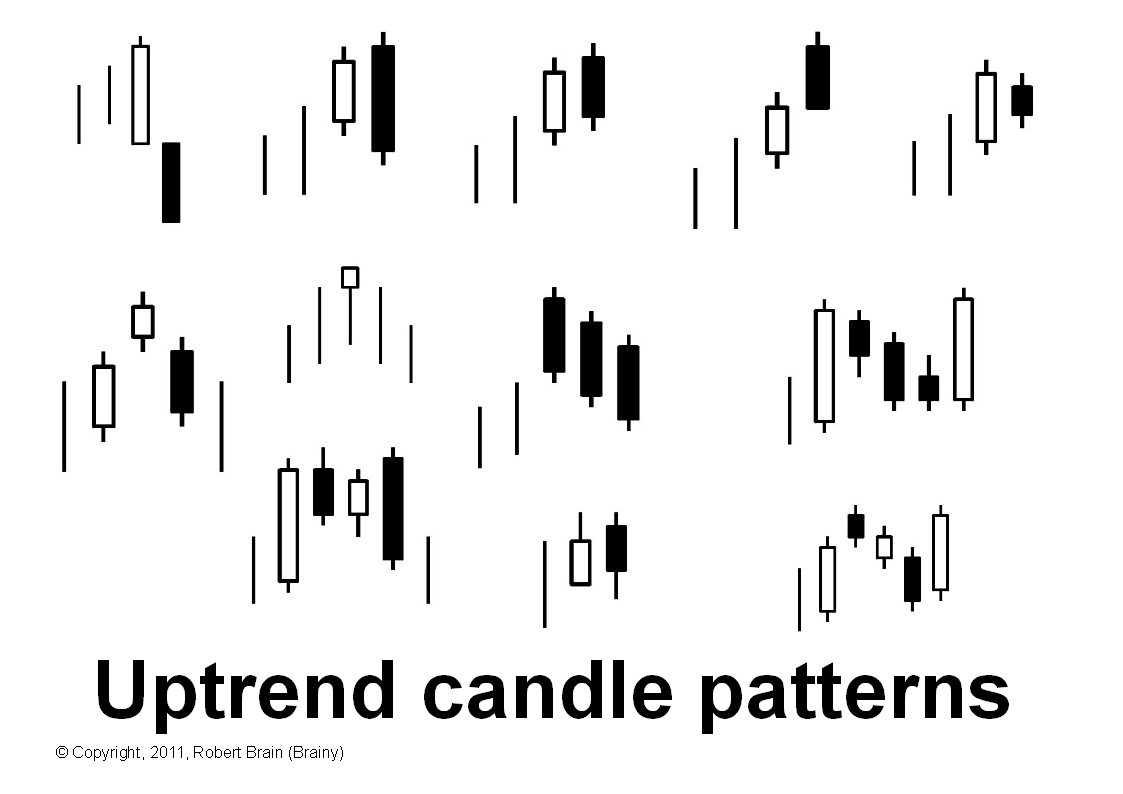

Candle

patterns in Up Trends

Most of these are reversal patterns, but not all:

- Bearish Engulfing

- Dark Cloud Cover

- Bearish Counterattack

- Bearish Harami

- Bearish Kicker

- Evening Star

- Hanging Man

- Three Black Crows

- Tweezer Top

- Tower Top

- Rising Three Method

- Bullish Mat Hold

Can you see similarities in the top row of 5 candle patterns in this

diagram?

The black candle in each case is less bearish than the one before.

All patterns in this diagram are bearish top reversal patterns, except

two.

Do you know which two and why?

Toolbox

Members see UP TRENDS details and identify candle

patterns here including the same diagram with pattern names

included.

Also see a description of the psychology at play on the Candle Features page.

|

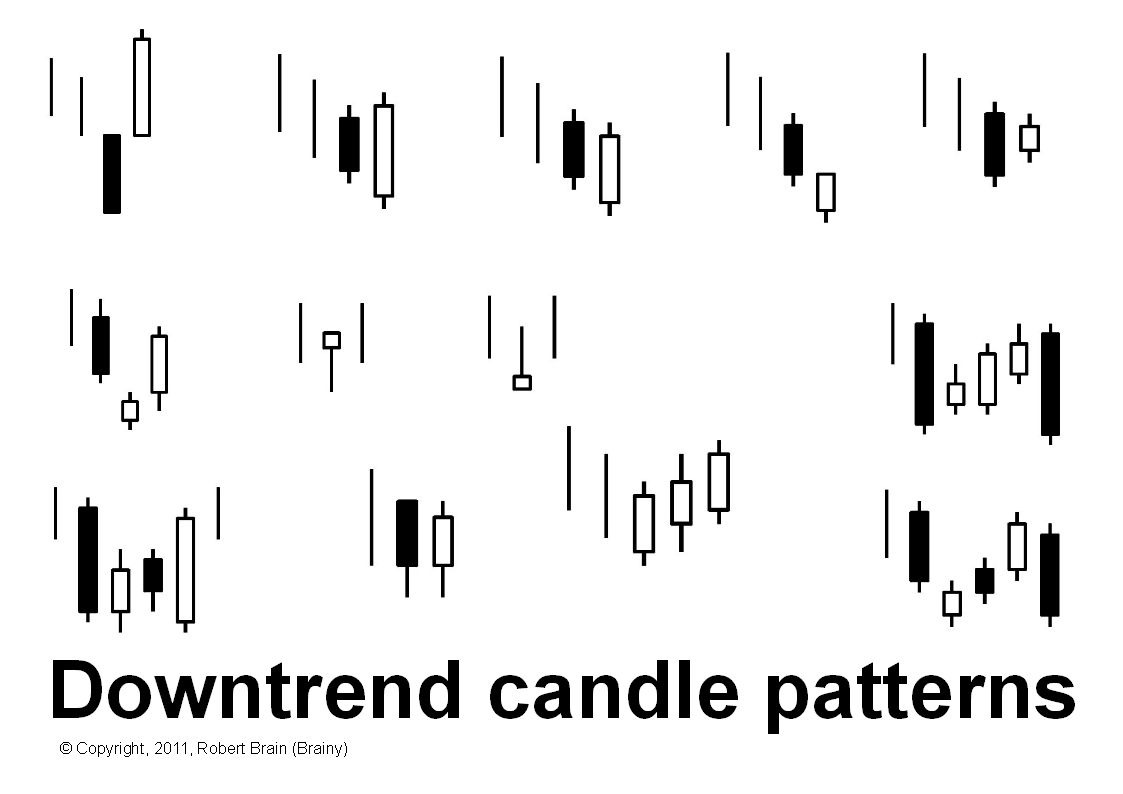

Candle

patterns in Down Trends

Most of these are reversal patterns, but not all:

- Bullish Engulfing

- Piercing

- Bullish Counterattack

- Bullish Harami

- Bullish Kicker

- Morning Star

- Hammer

- Inverted Hammer

- Three White Soldiers

- Tweezer Bottom

- Tower Bottom

- Falling Three Method

- Bearish Mat Hold

Can you see similarities in the top row of 5 candle patterns in this

diagram?

The white candle in each case is less bullish than the one

before.

All patterns in this diagram are bullish bottom reversal patterns,

except two.

Do you know which two and why?

Toolbox

Members see DOWN TRENDS details and identify candle

patterns here, including the same diagram with pattern names

included, and some real Aussie stock/index samples of the same.

Also see a description of the psychology at play on the Candle Features page.

|

|

|

More information

There are some free eBook (PDF) Articles on candles listed here. Other Articles are in

the Toolbox.

Useful

Links

The following web sites have lots of free information about

candlestick charts and patterns.

History and more at Wikipedia

Bulkowski's Candlestick Patterns

My SMP (Stock Market Power)

Master the Markets - Japanese Candlesticks

Features

Sensible

Investing - Ask yourself if the advice you receive

seems sensible.

Funda-Technical

Analysis - A clever blend of Fundamental Analysis

to identify quality stocks for a watch list, and Technical Analysis to

time the purchase (and sale) of the stocks to minimise losses and

maximise profit and capital.

Contrarian Investing Redefined

- The old thinking about contrarian investing now ought to be

challenged, and somewhat clarified or redefined.

Whatever

you do,

beware of the sharks

in the ocean!

|