|

Dear

Reader,

Welcome to the 5th edition of my weekly

BullCharts software Tip Sheets, focussing on tips and hints relating to

the use of the Australian BullCharts charting software package.

Firstly, let me observe that the markets finished the week at a new

Lower Close (XAO 3300); but not lower than the XAO intraday Low of 3201

on 21 Nov 2008. Many technical analysts are now saying that the last

"recent" technical support level is breached, and that the market is

heading down to make a new much lower low. The next major support level

is back in either 1999, 2001, or 2003. The target value could be in the

range of 2796 to 2927, or as low as 2666 (from 13/3/2003). (Please

remember that I am not a licensed financial advisor, so I do not

comment on the market and I do not provide any sort of financial or

investing advice. The words here are my own thoughts, just thinking out

loud.)

Some of the Elliott Wave enthusiasts are now also confirming their

earlier comment that the next big and severe downward wave is under

way. It's target price point and time frame depends on your wave count,

and your Gann interpretation.

Enough on the market. Let's get on with this week's BullCharts Tip

Sheet. This week I am extending the information from last week on scans

in BullCharts, and covering very specific information on the "Scan

Criteria" topic. For introductory information, or other BullScan

details, please see last week's Tip Sheet (in my web site archive - see

the link below) or my Monthly Brainy's eNewsletter articles.

Please feel free to send me feedback, or requests for additional

topics.

Topics in this week's newsletter: |

|

|

Advanced

trading topics - SPI Gap Filler strategy

BullCharts

scans - "2. Scan Criteria"

"First

Value to Compare > Category > price or chart field"

"First

Value to Compare > open/high/etc?"

"Type of

Comparison"

More

information

This

TipSheet might look strange?

|

| BullCharts scans - "2. Scan Criteria" |

|

|

In BullCharts, if you open an existing

Scan or create a new Scan, there are four tabs in the BullScan

Properties dialogue box. One of these tabs is "2. Scan Criteria". This

is where you can specify a number of "things" (or properties) about the

scan, to define which stock market data we will search through, and in

which time period, and which time frame, as well as the individual

"stock selection" (or "scan") criteria.

To create a new Scan Criteria, simply click on the "New..." button near

the bottom of the dialogue box.

In the notes below, we take a quick look at just some of the available

selection criteria. I will cover other options in future editions of

Brainy's Tip Sheets.

|

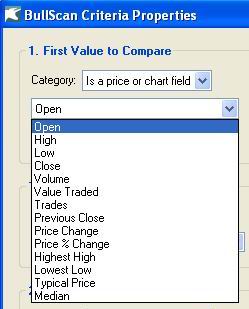

| "First Value to Compare > Category >

price or chart field" |

|

|

In the BullScan Properties dialogue

box, if you click on the "New..." button to create a new Scan Criteria,

the top portion of the next dialogue box ("BullScan Criteria

Properties") looks like the figure here. If you view the details of the

"Category" drop down, you will see there are six different types of

values that we can use for comparison.

In the text here we will only talk about the first option - "Is a price

or chart field". But, note the other options, including: "Is an

indicator", and "Is a fundamental". I will cover those in future Tip

Sheets.

|

| "First Value to Compare > open/high/etc?" |

|

If you choose "Is a price or chart

field" as the First value to compare (as described above), then you

have 14 different choices for the next drop-down (see the accompanying

figure).

The most commonly used ones include: Open, High, Low, Close and Volume.

But note there is also: "Value Traded" (ie. the dollar value), so that

you might choose only stocks with more than, say, $100,000 traded in a

day, or perhaps $500,000 in a week.

Also "Trades" (ie. the number of buy/sell transactions in the period -

day or week). You might want to choose only the stocks that have had

more than, say, 50 trades in a day (or 250 in a week). This will help

you avoid thinly traded stocks. If you want to exit the stock in a

hurry, there needs to be enough liquidity.

NOTE: If you have these criteria for stock selection, then they must be

recorded in your written version of your Trading Strategy (see Brainy's

Monthly eNewsletter articles for more details).

Also note these options: "Previous Close", "Price Change", and "Price %

Change". These help to compare a Close price to the previous close, or

to look at the actual change in price compared with a Close price at

some stage in the past - either in dollars, or percentage change. In

the latter case, you might want to search for a stock that has changed

by, say, 10% over a 5-day period.

Two other useful ones are "Highest High" and "Lowest Low". You can use

these to look for a situation over, say, an 8-bar period, or maybe 21

or 34 bars. If a stock is making Higher Highs, then perhaps an uptrend

is confirmed?

The last two on the list are "Typical Price", and "Median". More about

these in a future article.

|

| "Type of Comparison" |

|

|

Having chosen the "Price or Chart

field" option, and then a specific item, you can choose the "Type of

Comparison" to make. Remember that further down in the dialogue box is

the "2. Second Value to Compare" option. So the "Type of Comparison"

will compare the "First value..." with the "Second Value...". Depending

on how you think, sometimes it is useful to do it in this sequence:

- Set the "First Value to

Compare...", then

- Set the "Second Value to

Compare...", then

- Go back and set the "Type of

Comparison".

Just some of the different types of comparisons that are available are

shown in the accompanying diagram. There are actually 23 in all. A

useful and little known one is "Show this value", so that you can

specify an indicator or price field, and simply "Show it" in the scan

results table. In this situation, the "2. Second value to Compare"

options are greyed out and not available.

Other useful values to "Show" include some of the 20 "Fundamental"

values: Total Issue, EPS, PE, Dividend yield, Dividend date, etc.

There are far too many options here to cover in detail in these short

Tip Sheets, so they will be covered in more detail in Brainy's Monthly

eNewsletter articles.

IMPORTANT NOTE: If you are comparing two price or chart fields, then

there is something important to note about the "Type of Comparison".

There are two more drop-down boxes: "Any/Every", and the number of bars

for comparison. If the number of bars is set to one, then the Any/Every

drop-down box is ignored. So it does not matter whether you specify

"Any" or "Every". This can be a source of confusion for someone trying

to understand how all this works.

|

| More information |

|

|

More details on scans and how to create and

customise them are included in Brainy's Monthly eNewsletters that are

available to subscribers (for a very modest amount). Feel free to click

on the relevant link at right to view samples and more details.

These weekly Tip Sheets for BullCharts* users are intended to be short,

quick grabs of information. They are not a replacement for the monthly

detailed Brainy's eNewsletter articles, which cover these same topics

but in much more detail. The eNewsletters article also cover Technical

Analysis and Share Trading topics.

Also see the BullCharts on-line help (in BullCharts, hit the F1 key),

and the relevant User Guide Chapter for more details (this is supplied

with the software and copied to your hard drive as a PDF file).

Note: Any screen shots shown in this newsletter are snapped from

BullCharts version 3.8 (which will be available very soon).

FEEDBACK? - I am very keen to receive feedback about these weekly

BullCharts Tipsheets. Please feel free to email me with comments, or

suggestions.

* - BullCharts

is: "...an innovative charting and technical analysis system.

It provides a feature rich and powerful set of tools with access to the

latest strategies from local and overseas authors in analysing the

dynamics of the stock market."

|

| This TipSheet might look strange? |

|

|

This TipSheet has been composed in

HTML and distributed using an online service, and is intended to be

viewed in HTML (ie. web language) format. Some parts might look a

little strange, especially if you are viewing a basically text-only

version. I am working on a text-only version.

We have also found that some web-mail clients (eg. Hotmail and Yahoo

mail) can mess up some aspects.

Please feel free to send me feedback if anything looks strange.

|

|

|